Orderflow and Volume Tools

Follow the orderflow that moves the markets to capitalize on the next big trends before the world knows about it.

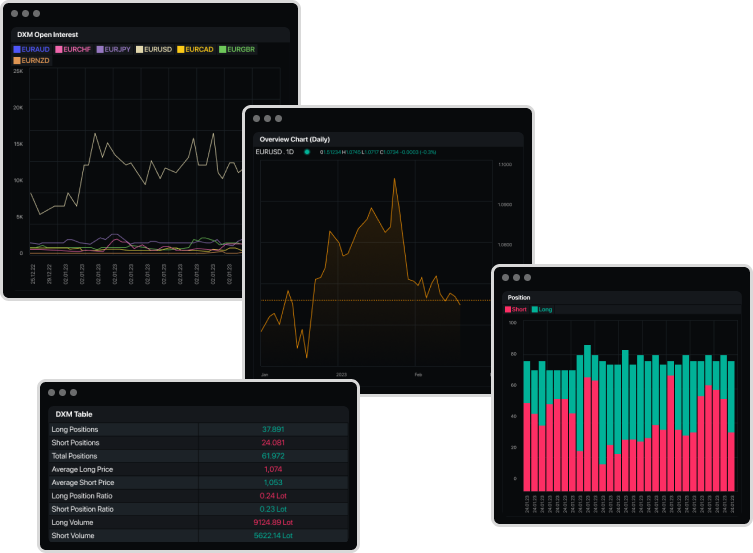

Retail Position- and Orderbook

The Position Book aggregates the open positions and orders of traders using our one of the biggest fx brokers, offering a comprehensive snapshot of market sentiment directly at your fingertips.

Instantly see the balance between long and short positions among traders on our platform, offering a clear indication of overall market sentiment. A predominantly bullish or bearish sentiment among retail traders can guide your trading decisions into the right bias.

Our Position Book highlights key price levels where significant numbers of orders are concentrated. These areas often represent potential support and resistance levels, crucial for planning entry and exit points.

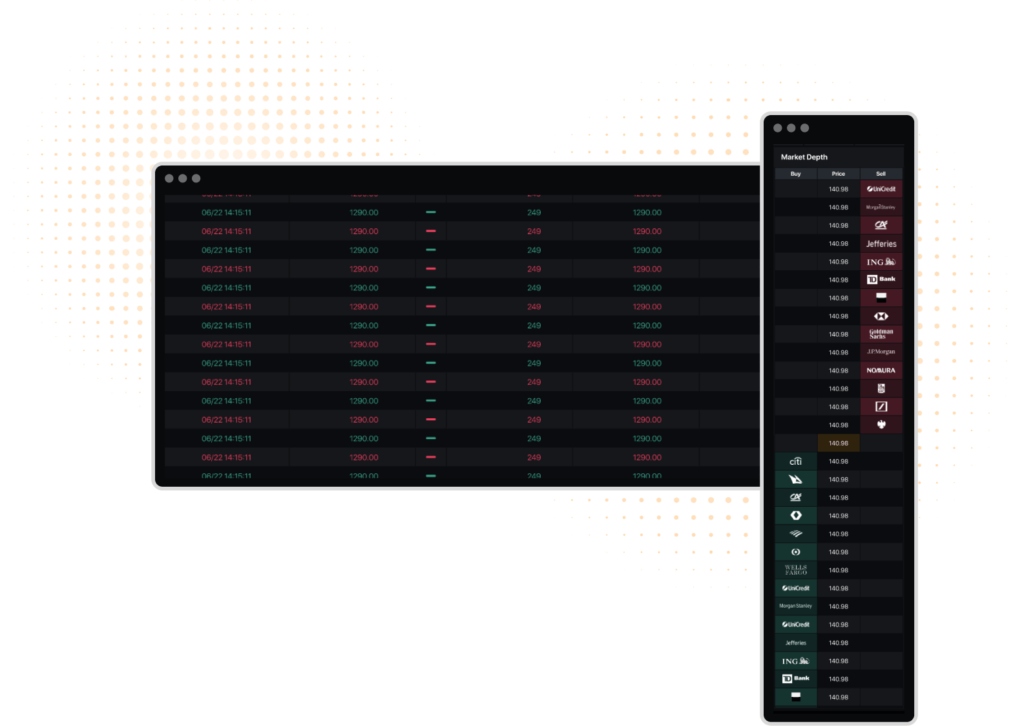

Orderflow tools

Our Orderflow tools are an innovative addon that provides users with a unique visual representation of market liquidity and dynamics in real time. It’s distinguished by its ability to display the entire market depth and order flow, using a heat map to illustrate the levels of supply and demand across different price points. This visualization technique offers traders a deeper understanding of market behavior, helping them make more informed decisions.

The Footprintcharts offers a dynamic, color-coded overviews that displays real-time bid and ask volumes. This allows traders to see how liquidity is distributed across different price levels, making it easier to identify potential support and resistance areas.

By visualizing the live order flow, traders can see the actual buy and sell orders as they are placed and executed. This insight into the flow of orders can help predict short-term price movements based on the imbalance of buying and selling pressure. These tools can help traders identify potential trade setups based on changes in market liquidity and order flow dynamics.

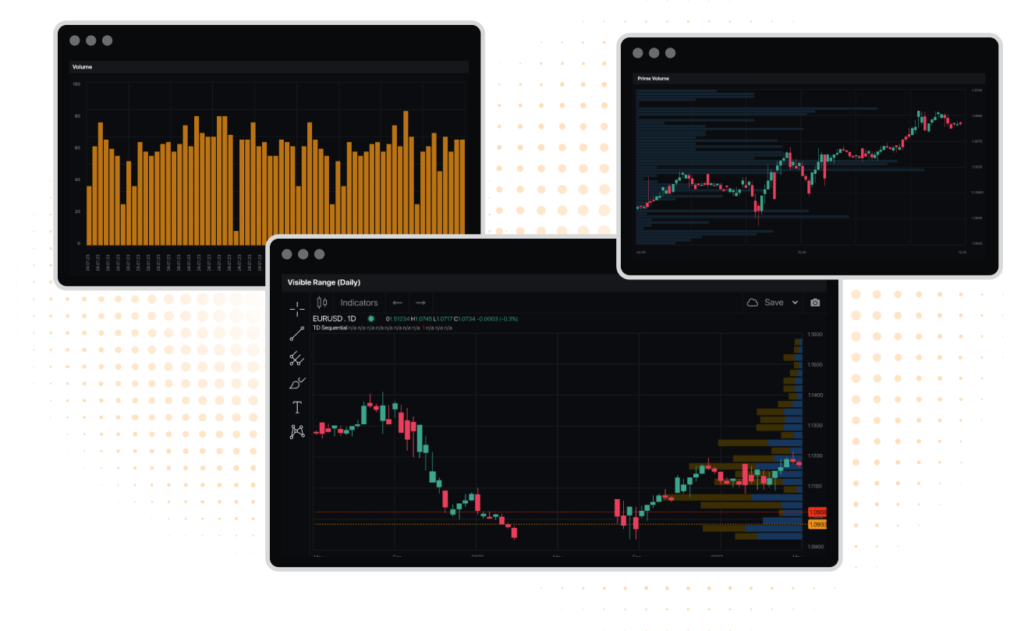

Realtime Volume Analysis

Volume is more than just a number—it’s the pulse of the market, offering invaluable insights into the strength and direction of price movements. At PMT, we understand the pivotal role volume analysis plays in crafting successful trading strategies. That’s why we’ve equipped our platform with an extensive array of volume tools and indicators, designed to provide traders with a deeper understanding of market dynamics and empower their decision-making process.

Our realtime Volume Indicators graphically represents the trading volume for each period, laying the groundwork for a robust analysis of market sentiment and momentum. ive deeper with OBV, a cumulative indicator that correlates volume with price trends. By highlighting the flow of volume, OBV serves as a critical tool for confirming trends and forecasting potential reversals.

Along with many other Volume tools including Volume-Weighted Average Price (VWAP), Accumulation/Distribution Line (A/D Line), Volume Profile,Chaikin Money Flow (CMF), Volume Profile you gain comprehensive volumeflows tools for a better decision making.

Many other functions and widgets inside PMT

Prime Market Terminal offers a variety of tools and data to analysis macro economics in the bigger picture around the world. Explore now the PMT Economic Calendar, Worldbook and many other useful tools to analyse Macro Data.

Gain access to a wealth of professional research within PMT, authored by industry experts and analysts. Dive deep into insightful research, market analysis, and investment strategies to enhance your understanding of various sectors, asset classes, and specific investment opportunities.

Read the news that moves the markets first to capitalize on the next big trends before the world knows about it. Utilize Realtime Headline Tickers, wide News Coverage and a complete Reading Desk to always stay ahead of the curve.

All rights received , © 2023 - 2024 - PrimeMarket Terminal