Edge-giving Data

Gain access to unique data providing a significant edge that will massively improve your overall bias determination.

Seasonality

Let the hidden rhythms of the markets become your roadmap to smarter decisions and enhanced returns. Anticipating moves by leveraging the power of seasonal trends that have repeated year after year.

Our cutting-edge platform is designed to unveil the seasonal patterns in financial markets, offering you a clearer view of when to buy, sell, or hold. By analyzing historical data across stocks, commodities, and currencies, PMT reveals the times of year when markets are statistically more likely to rise or fall.

This isn’t just data—it’s your strategic advantage. Dive deep into years of market data to uncover recurring trends, enabling you to make moves with confidence. Every trend is backed by robust statistical analysis, providing you with not just information, but assurance.

Incorporate seasonal trends into your approach, turning predictable market movements into opportunities for growth. Let PMT do the heavy lifting, delivering comprehensive analysis without the need for manual data crunching.

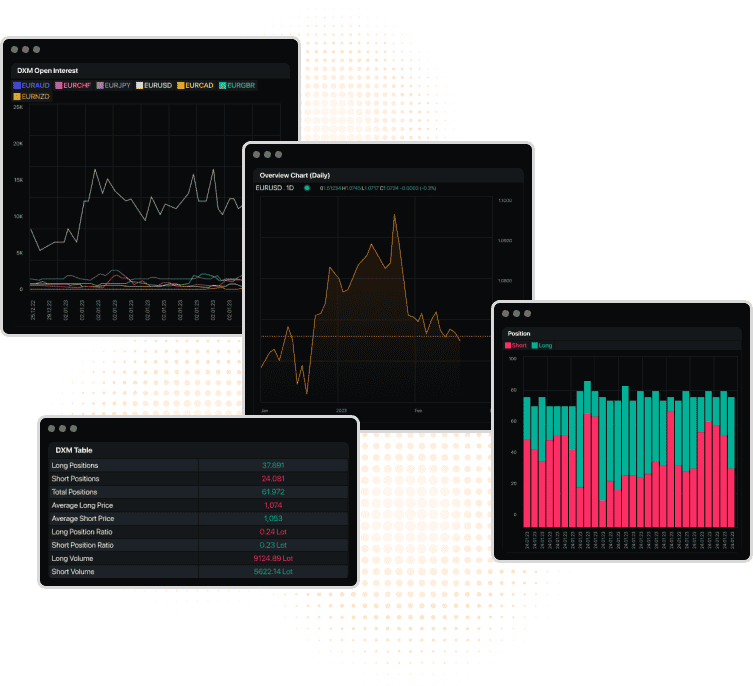

Realtime Sentiment

The Dumb Money Index (DMX) is an innovative tool tailored for forex traders, offering an automated, real-time analysis of the behaviors and strategies of thousands of retail traders. By compiling and presenting a variety of trading positions and approaches within its community, it serves as a comprehensive gauge of current market sentiment.

It’s widely acknowledged that a significant majority, approximately 90-95%, of retail traders experience losses in the long run. Imagine consistently positioning yourself on the winning side of trades. Market Makers capitalize on this dynamic daily, exploiting retail liquidity knowledge to their advantage. Hence, retail sentiment emerges as a crucial instrument for both day trading and identifying pivotal trend shifts at critical levels.

Our tool acts as a sentiment barometer, drawing from transactions between liquidity providers and buyers to display the balance between long and short positions. This barometer not only signals potential shifts in market dynamics but also allows you to gauge speculative interest in assets, serving as a powerful contrarian indicator.

With updates every 1 minute, access live data encompassing extensive historical analysis, ratios of long/short positions, average entry prices, and more, across various timeframes. Equip yourself with this pivotal information to navigate the markets with greater insight.

Advanced CFTC COT Report

Dive deep into the dynamics of the futures market with our cutting-edge COT (Commitment of Traders) Report. This powerful analytical tool is designed to provide you with unparalleled insights into how major groups are positioning themselves in the market, predicting emerging trends with high accuracy. You gain access to early information on market movements before the major trends take hold, offering you a significant advantage.

Our software offers an in-depth look at the smart money’s market positioning, providing clear insights into the strategies of the most informed players. By understanding the actions of commercial traders, who often represent the largest and most informed group, you’re better positioned to align your trades with those likely to gain substantial profits.

For those familiar with the nuances of the COT report, this tool becomes an indispensable part of their trading arsenal. It simplifies the complexity of CFTC data, allowing you to interpret signals and make informed decisions swiftly.

By offering a comprehensive view of market sentiment and trader positioning, it equips you with the knowledge to make confident, informed trading decisions. Whether you’re looking to refine your trading strategy or seeking to gain a deeper understanding of market dynamics, our software is designed to meet your needs.

Social Sentiment

Tracking trading-related discussions on social media platforms like Twitter or Reddit can be incredibly time-consuming. To streamline this process, we’ve developed a cutting-edge social sentiment algorithm, powered by the latest advancements in machine learning technology. This algorithm meticulously scans a wide array of social media sites, efficiently catering to your informational needs.

Among the myriad applications of AI, sentiment analysis emerges as a field of particular interest to us. By harnessing AI, we can automate and accelerate the process of analyzing social media content, gaining valuable insights into public conversations about companies and their products.

Our algorithm leverages machine learning, specifically neural networks, to sift through social media posts. We have meticulously trained this neural network to recognize and interpret the underlying sentiments of these posts. Through rigorous training and fine-tuning, the neural network has achieved the capability to independently assess sentiments with remarkable accuracy.

This level of analysis presents a unique opportunity to gauge public sentiment, allowing you to evaluate how it might influence stock values. Our AI-driven approach not only saves you time but also provides a nuanced understanding of the market sentiment derived from social media discourse.

Many other functions and widgets inside PMT

Prime Market Terminal offers a variety of tools and data to analysis macro economics in the bigger picture around the world. Explore now the PMT Economic Calendar, Worldbook and many other useful tools to analyse Macro Data.

Gain access to a wealth of professional research within PMT, authored by industry experts and analysts. Dive deep into insightful research, market analysis, and investment strategies to enhance your understanding of various sectors, asset classes, and specific investment opportunities.

Read the news that moves the markets first to capitalize on the next big trends before the world knows about it. Utilize Realtime Headline Tickers, wide News Coverage and a complete Reading Desk to always stay ahead of the curve.

All rights received , © 2023 - 2024 - PrimeMarket Terminal