Table of Contents

Introduction

What is Seasonality in Forex Trading

Seasonality is a phenomenon that occurs in financial markets where specific patterns or trends appear at certain times of the year. These patterns can be analyzed using historical data to gain insights into expected market behavior. In the context of forex trading, seasonality involves recognizing and analyzing the historical trends of currency pairs based on the time of year. For example, some currencies may experience increased volatility during certain months due to factors such as changes in government policies, economic events, or seasonal trends in the underlying industries.

Significance of Seasonality

Traders and investors have used seasonal patterns in various financial markets, including forex. These patterns often reflect predictable changes in market sentiment, economic activity, and geopolitical events, influencing currency values.

Identifying Seasonal Patterns in Forex

Using Historical Data Analysis Techniques

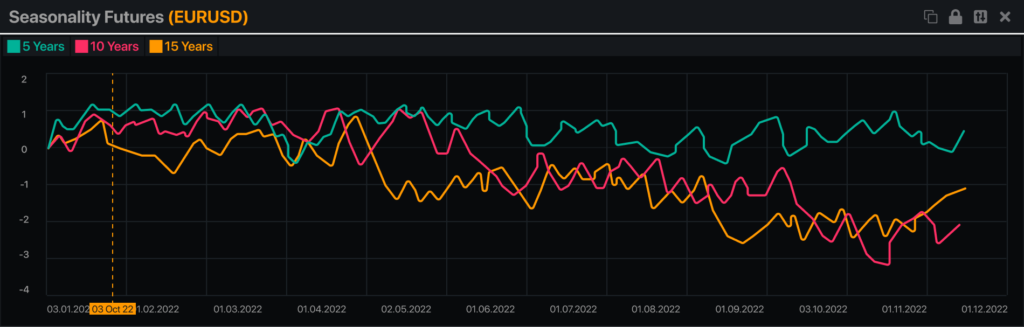

Traders use historical price data to identify recurring seasonal trends in currency pairs. By analyzing past performance during specific time periods, such as months or quarters, traders can identify patterns and anticipate potential future movements.

Common Seasonal Trends in Major Currency Pairs

Some currency pairs exhibit consistent seasonal patterns based on factors such as interest rate decisions, economic data releases, and geopolitical events. For example, the USD may experience increased volatility around U.S. Federal Reserve meetings, affecting its value against other currencies.

Factors Influencing Seasonal Patterns

Economic Indicators and Events

Key economic indicators, such as GDP growth, inflation rates, and employment data, can influence seasonal trends in currency markets. Traders monitor these indicators to anticipate shifts in market sentiment and adjust their trading strategies accordingly.

Geopolitical Factors

Political events like elections, geopolitical tensions, and trade negotiations can impact currency values and create seasonal patterns. Traders must stay informed about geopolitical developments and their potential effects on currency markets.

Central Bank Policies

Central bank decisions, such as interest rate changes and monetary policy announcements, can significantly affect currency markets. Seasoned Traders analyze central bank statements and speeches to gauge future monetary policy directions and anticipate currency movements.

Benefits of Trading with Seasonality

Risk Management

By combining seasonal analysis into their trading strategies, traders can better manage risk by identifying periods of increased volatility or potential market reversals. “Access to this information enables traders to make decisions, which can prevent unexpected losses and protect their interests.”

Profit Maximization

Seasonal trends provide traders with opportunities to capitalize on predictable market movements and maximize profits. By aligning their trading activities with seasonal patterns, traders can increase the likelihood of successful trades and optimize their returns.

Leveraging Seasonal Trends for Long-Term Gains

Diversification of Trading Portfolios

Combining seasonal analysis into trading portfolios can help traders diversify risk and enhance overall portfolio performance. By trading across different currency pairs and asset classes, traders can spread risk and capitalize on diverse seasonal opportunities.

Capitalizing on Predictable Patterns

Seasonal trends often repeat over time, allowing traders to anticipate market movements and make informed trading decisions. By studying historical data and identifying recurring patterns, traders can gain a competitive edge and achieve long-term trading success.

Key Metrics and Indicators for Seasonal Analysis

Moving Averages

Moving averages help traders identify trends and potential reversals in currency markets by smoothing out price fluctuations. Traders use moving average crossovers and trend analysis to confirm seasonal patterns and identify entry and exit points.

Oscillators

Oscillators, such as the Relative Strength Index (RSI) and the Stochastic Oscillator, help traders identify overbought or oversold conditions in currency markets. By combining oscillator signals with seasonal analysis, traders can confirm potential trade setups and manage risk more effectively.

Fundamental Analysis Tools

Economic Calendars

Economic calendars provide traders with a schedule of upcoming economic events and data releases that may impact currency markets. Traders use economic calendars to plan their trading activities around significant events and adjust their strategies accordingly.

Central Bank Announcements

Central bank announcements, such as interest rate decisions and monetary policy statements, can significantly impact currency values. Traders closely monitor central bank communications to anticipate market reactions and adjust their positions accordingly.

Sentiment Analysis in Seasonal Trading

Market Sentiment Indicators

Sentiment indicators, such as the Commitment of Traders (COT) report and trader positioning data, provide insights into market sentiment and positioning. Traders use sentiment analysis to gauge market sentiment and confirm seasonal trends.

Social Media Analysis Tools

Social media platforms and online forums can provide valuable insights into market sentiment and trader sentiment. Traders monitor social media discussions and sentiment analysis tools to gauge market sentiment and identify potential trading opportunities.

Incorporating Seasonality into Trading Plans

Backtesting Strategies

Traders use historical data and backtesting techniques to evaluate the performance of seasonal trading strategies. Traders can assess their effectiveness and refine their approach by backtesting strategies over multiple market cycles.

Creating Seasonal Trading Plans

Traders develop comprehensive trading plans that incorporate seasonal analysis, risk management strategies, and entry and exit criteria. Seasonal trading plans outline specific trading rules and objectives to guide decision-making and maximize trading success.

Risk Management Techniques in Seasonal Trading

Stop Loss Orders

Stop loss orders help traders limit losses and protect capital in the event of adverse market movements. Traders set stop loss levels based on their risk tolerance and the currency pair’s volatility, ensuring disciplined risk management.

Position Sizing Strategies

Position sizing strategies help traders determine the appropriate size of each trade based on their account size, risk tolerance, and trading objectives. Traders adjust position sizes to account for seasonal trends, volatility, and risk-reward ratios, optimizing portfolio performance.

Practical Tips for Trading with Seasonality

Start Small and Learn

Beginner traders should start with small trades and focus on learning about seasonal patterns and trading strategies. By gaining experience and gradually increasing trade size, traders can build confidence and improve their trading skills over time.

Keep a Trading Journal

Keeping a trading journal allows traders to track their trades, analyze performance, and identify areas for improvement. Traders record details such as entry and exit points, trade rationale, and lessons learned from each trade, facilitating continuous learning and development.

Advanced Strategies for Seasonal Traders

Pairing Seasonality with Technical Analysis

Advanced traders combine seasonal analysis with technical indicators and chart patterns to confirm trade setups and enhance their trading strategies. By integrating multiple analysis techniques, traders can increase the accuracy of their trade decisions and achieve consistent results.

Combining Seasonal Insights with Fundamental Analysis

Seasonal traders incorporate fundamental analysis into their trading strategies to assess the underlying drivers of seasonal trends and anticipate future market movements. By analyzing economic data, central bank policies, and geopolitical events, traders gain a deeper understanding of seasonal patterns and their potential impact on currency markets.

Challenges and Risks in Seasonal Trading

Overreliance on Historical Data

While historical data provides valuable insights into seasonal patterns, traders must be cautious not to rely solely on past performance when making trading decisions. Market conditions may change, and unexpected events can disrupt seasonal trends, requiring traders to adapt their strategies accordingly.

Adapting to Changing Market Conditions

Seasonal patterns may evolve over time due to changes in economic, geopolitical, and market dynamics. Traders must continuously monitor market conditions and adjust their trading strategies to reflect changing trends and opportunities in currency markets.

Managing Emotional Biases in Seasonal Trading

Emotions such as fear, greed, and overconfidence can influence trading decisions and lead to irrational behavior. Seasonal traders must maintain discipline, stick to their trading plans, and avoid