Table of Contents

Introduction

Economic indicators play a crucial role in guiding traders’ decisions. Among the most influential of these indicators are the ADP Non-Farm Payroll (ADP NFP) and the Non-Farm Payroll (NFP) reports. Understanding these reports, their similarities and differences, their importance, and how to trade them effectively can significantly enhance your trading strategy.

Understanding ADP Non-Farm Employment Change and Non-Farm Payroll

What is ADP Non-Farm Employment Change

The ADP Non-Farm Employment Change report is a monthly employment report produced by the ADP Research Institute in collaboration with Moody’s Analytics. It estimates the number of private-sector jobs added or lost in the United States during the previous month, excluding government jobs, agriculture, and non-profit organization employment. Released two days before the official NFP report, it serves as an early indicator of labor market health.

What is Non-Farm Payroll (NFP)

The NFP report is a comprehensive monthly employment report released by the U.S. Bureau of Labor Statistics (BLS). It measures the change in the number of employed people during the previous month, excluding farm workers, private household employees, and employees of non-profit organizations. The NFP report includes both private and public sector employment data and is typically released on the first Friday of each month.

Similarities Between ADP Non-farm Employment Change and Non-Farm Payroll

Frequency and Timing

Both reports are released monthly and provide a snapshot of the U.S. labor market. The ADP Nonfarm Employment Change is released two days before the NFP report, offering a preview of the official government data.

Focus on Employment

Both reports measure employment changes, providing insight into the number of jobs created or lost in the U.S. economy. This data is crucial for assessing economic health and trends.

Market Impact

Both reports can significantly impact forex markets. Positive employment data typically strengthens the U.S. dollar, while negative data can weaken it. Traders closely monitor both reports to anticipate market movements.

Differences Between ADP Non-farm Employment Change and Non-Farm Payroll

Data Source

- ADP Non-farm Employment Change: Compiled by a private organization (ADP Research Institute) using payroll data from ADP clients.

- NFP: Compiled by a government agency (BLS) using a broader range of data sources, including surveys and administrative records.

Scope of Data

- ADP Non-farm Employment Change: Focuses solely on private-sector employment.

- NFP: Includes both private and public sector employment data.

Predictive Nature

- ADP Non-farm Employment Change: Often viewed as a predictor or leading indicator for the official NFP report. However, it can sometimes diverge significantly from the NFP figures.

- NFP: Considered the more comprehensive and authoritative report, often setting the definitive tone for market sentiment.

Importance of ADP Non-farm Employment Change and Non-Farm Payroll in Forex Trading

Economic Indicator

Both reports provide vital information about the health of the U.S. economy. Strong employment growth suggests economic expansion, which can lead to higher interest rates, attracting foreign investment and boosting the U.S. dollar.

Monetary Policy Influence

Central banks, including the Federal Reserve, monitor employment data to guide monetary policy decisions. Consistently strong employment data may prompt the Fed to raise interest rates, influencing forex markets.

Market Volatility

The release of these reports often leads to increased volatility in forex markets. Traders seek to capitalize on these movements by positioning themselves ahead of or immediately after the data releases.

Trading Strategies for ADP Non-farm Employment Change and Non-Farm Payroll

Pre-Release Positioning:

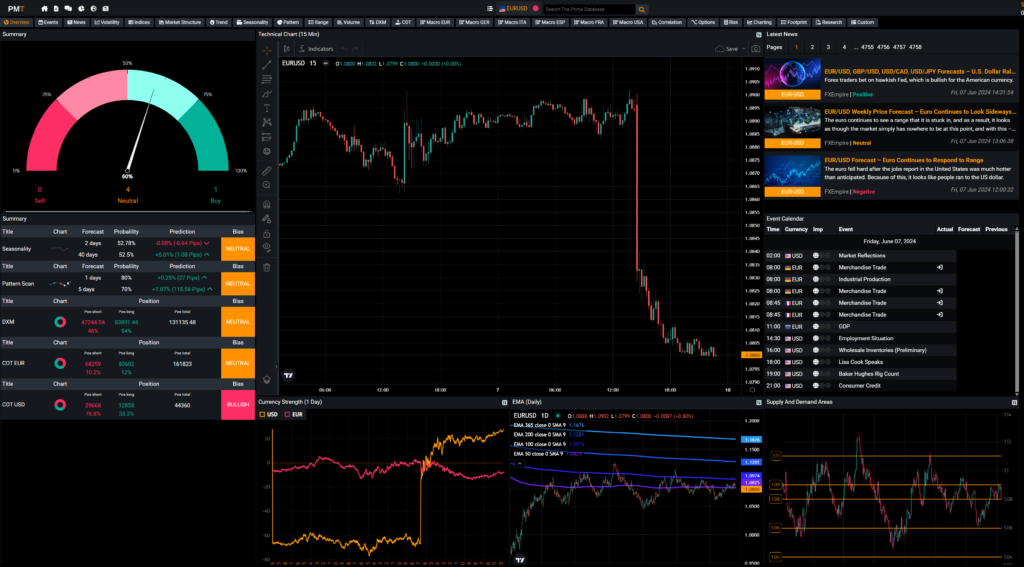

Some traders choose to take positions before the release based on their predictions of the report outcomes. This strategy involves significant risk due to the potential for unexpected results. However, with the Prime Market Terminal research tool, traders have access to data and forecasts from financial institutions and hedge funds based on their own surveys and analysis. With these data, a trader can take a pre-release position, thereby taking the same position expected to be taken by these financial institutions and hedge funds.

Post-Release Reaction

Many traders prefer to wait for the reports to be released and then trade based on the actual data. This approach reduces the risk associated with predictions but requires quick decision-making to capitalize on market movements. The DXM, which is one of Prime Market Terminal’s powerful tools, is perfect for post-release strategy.

The role of the DXM order flow is to identify most retail traders’ sentiment trends and trade against their positions. Most retailers fail in the long term, while the hedge funds and institutions take the opposite position of the retail traders.

Straddle Strategy

This involves placing both a buy and a sell order simultaneously, with the intention of capturing movement in either direction. Traders set stop orders above and below the current market price to enter the market as soon as the data is released.

Traders who prefer to use the straddle strategy can use Prime Market Terminal’s range of tools, such as volume, range, trend, and order block. These tools provide traders with information on support, resistance, order blocks, and liquidity areas with which traders can place a pending buy order or sell order entry.

Use of Technical Analysis

Combining technical analysis with fundamental data can enhance trading decisions. Traders might look for essential support and resistance levels to set entry and exit points based on anticipated market reactions to the reports.

On Prime Market Terminal, traders can analyze the market based on their preferred technical analysis, i.e., support, resistance, moving averages, Bollinger bands, among others, and at the same time, real-time sentimental data, economic data, news alerts, trends, seasonality, COT, and DXM among other tools on a single page, thereby having access to arrays of data to make accurate and precise trading decisions.

Risk Management

Due to the high volatility associated with these reports, effective risk management is crucial. This includes setting appropriate stop-loss orders, sizing positions correctly, and being prepared for potential slippage.

Proper risk management is required for a trader to be profitable. With Prime Market Terminal risk tool, a trader can calculate and draw his potential position on a chart and monitor this using the risk tool. This tool assists traders in planning with a flawless risk-to-reward ratio.

Conclusion

The ADP Non-farm Employment Change and Non-Farm Payroll reports are essential for forex traders and investors. Although they both focus on employment data and affect the markets, they have distinct data sources, scope, and timing. Understanding these differences, their role in economic analysis, and how to trade them effectively can provide traders with valuable insights and opportunities in the forex market.

By utilizing the analysis features of Prime Market Terminal, you can make informed decisions and take advantage of the market movements they create. However, it’s important to remember that while trading with these reports can be profitable, it also involves significant risk, so always use proper risk management practices.